First Quarter Strategic Income Outlook

Published on January 14, 2025

Although we are loath to make predictions, conditions appear to be favorable for fixed income in the coming year, and we think investors should consider adjusting their allocations accordingly.

Magic 8-Ball Says, “Cannot Predict Now”

2024 was a very good year for most U.S. investors. Reading the tea leaves for what 2025 and beyond may bring is tricky at best given how far some markets have rallied. While no two cycles are identical, there are similarities with past cycles that we can learn from and apply to our current positioning. We believe that sector allocation and risk mitigation will be very important themes going forward.

The world is fraught with uncertainty both geopolitically and economically, with wide divergences between regions. This has as much to do with governance frameworks, such as overregulation in Europe, as with overinvestment, such as real estate and infrastructure overbuilding in China. Structural impediments are very difficult to reverse, and large capital misallocations are expensive to fix. America is in a unique position as arguably one of the strongest economies in the world, and there is hope that a reduction of the regulatory burden by the incoming administration will help that continue. The $64 trillion question is whether we stay stronger than most economies or weaken. Nobody knows at this point, but markets generally seem to be upbeat.

The New York Times had an interesting article on December 22nd titled “Reading Wall Street’s Irrelevant Market Predictions.” It compared year-ahead forecasts starting in December 2000 and found that the average prediction for equity market returns was for a gain of 8.8%, while never forecasting a down year. The average variance between these predictions and actual results was 14.2%. To quote, “being wrong by that much means that these forecasts weren’t merely inaccurate. They were completely out of bounds.” We agree. The article excuses the inaccuracies by pointing out that the “predictions are simply the results of their models.” No one knows how or when the current markets will reverse, but the old adage “an ounce of prevention is worth a pound of cure” is apt. Needless to say, we will not be making any year-ahead forecasts for market performance.

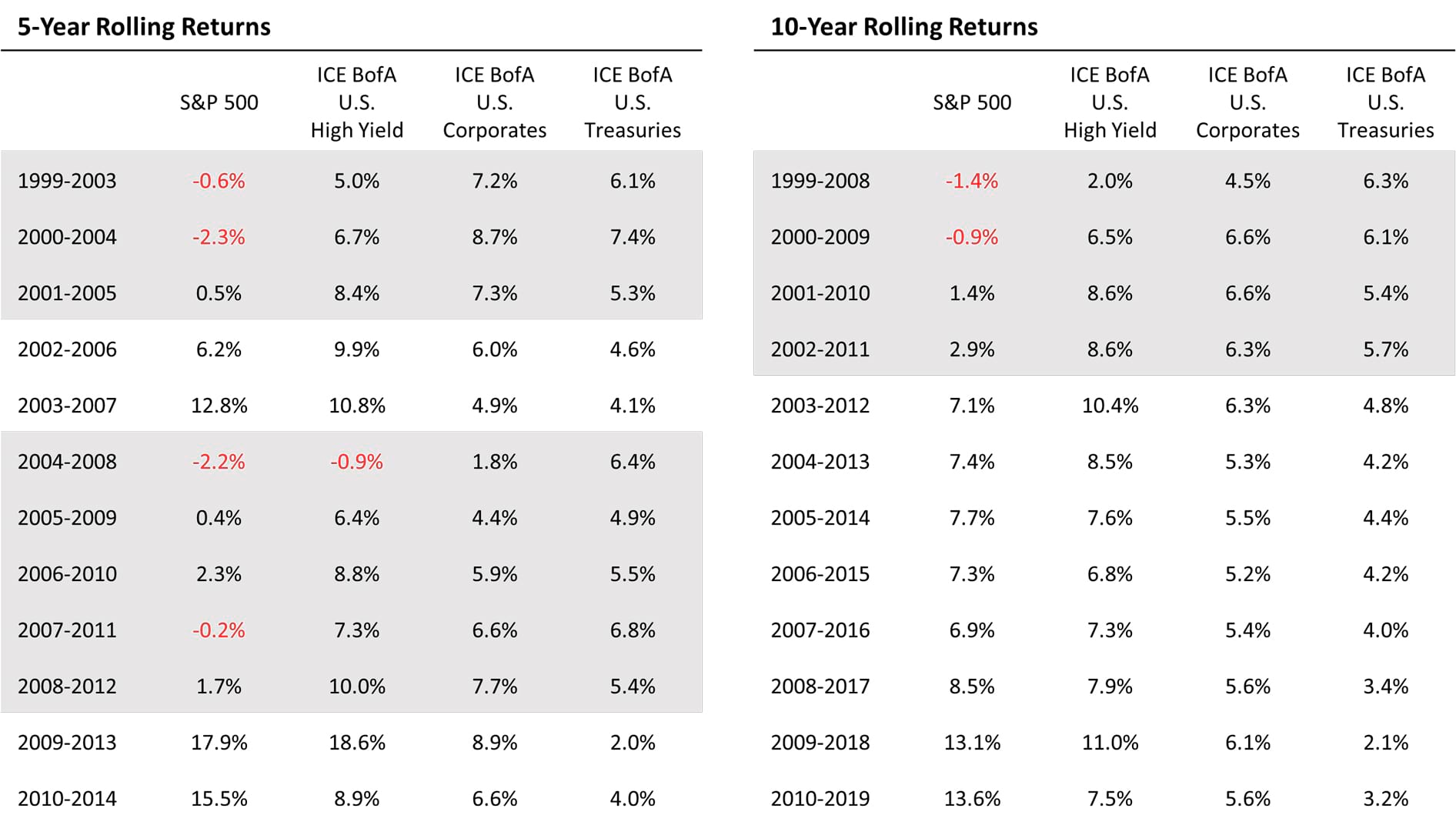

Equity markets have been making new highs throughout 2024, and valuations have not been this lofty since the dot-com bubble peak in early 2000. Market leadership back then was also very narrow, as it is today. The poster child for the internet age in 2000 was Cisco, which reached a valuation peak it has yet to surpass 25 years later, despite the company having grown revenues and earnings over that period. We do not know what the future holds for a company like Nvidia, which seems to be the current analog for the AI era. Taking a step back and looking at longer-term returns for a few broad asset categories following the 1999 peak may be a surprise to some and could be informative to future portfolio allocations. Below are five- and ten-year rolling returns starting in the year 2000 for the S&P 500, high yield corporate bonds, investment grade corporate bonds, and U.S. Treasuries:

As you can see, equities did not outperform any of the three major fixed income categories for subsequent rolling five- and ten- year periods roughly following the 2000 peak, as depicted by the highlighted rows in the tables (or for the 15-year period beginning in 1999, not shown). Moreover, an investment in the S&P 500 at the beginning of each year for the six years starting in 1999 underperformed the high yield index for each of the subsequent ten years. And finally, the cumulative returns for the S&P 500 starting from 1999 did not exceed that of high yield until year-end 2020, a 22-year lag (also not shown).

While active management can enhance returns, the fact that passive equities lagged fixed income and especially high yield bonds so persistently is eye-opening. The past five years have been outstanding for equity investors, as had the prior five years leading to the early 2000 peak. Whether events unfold in a similar fashion in coming years is not known, but it may pay to be alert to changes in leadership. Stay tuned.

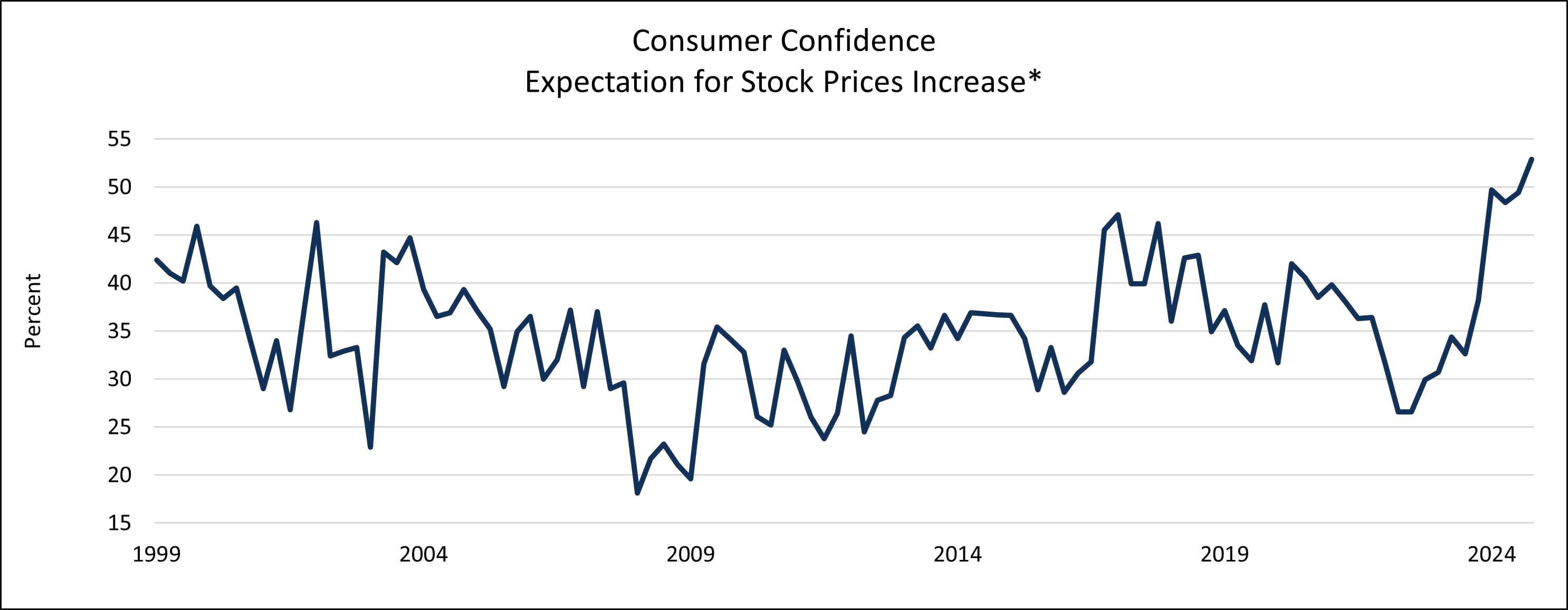

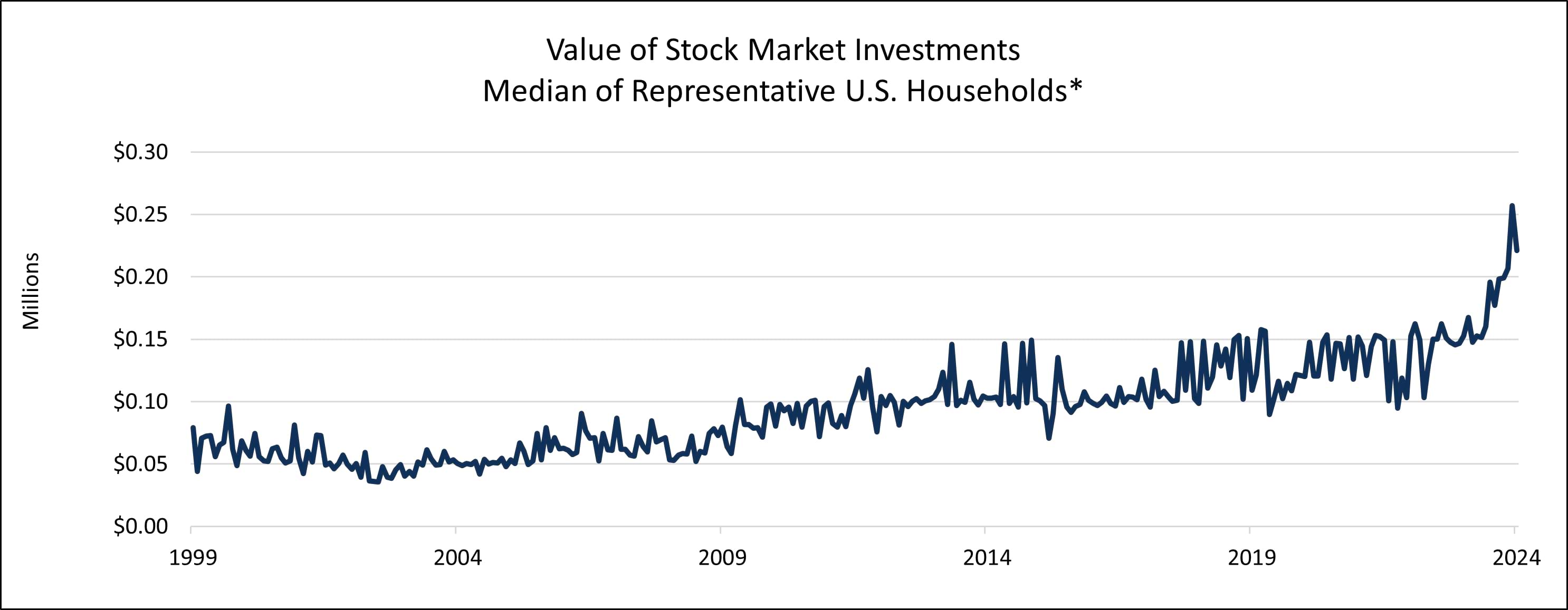

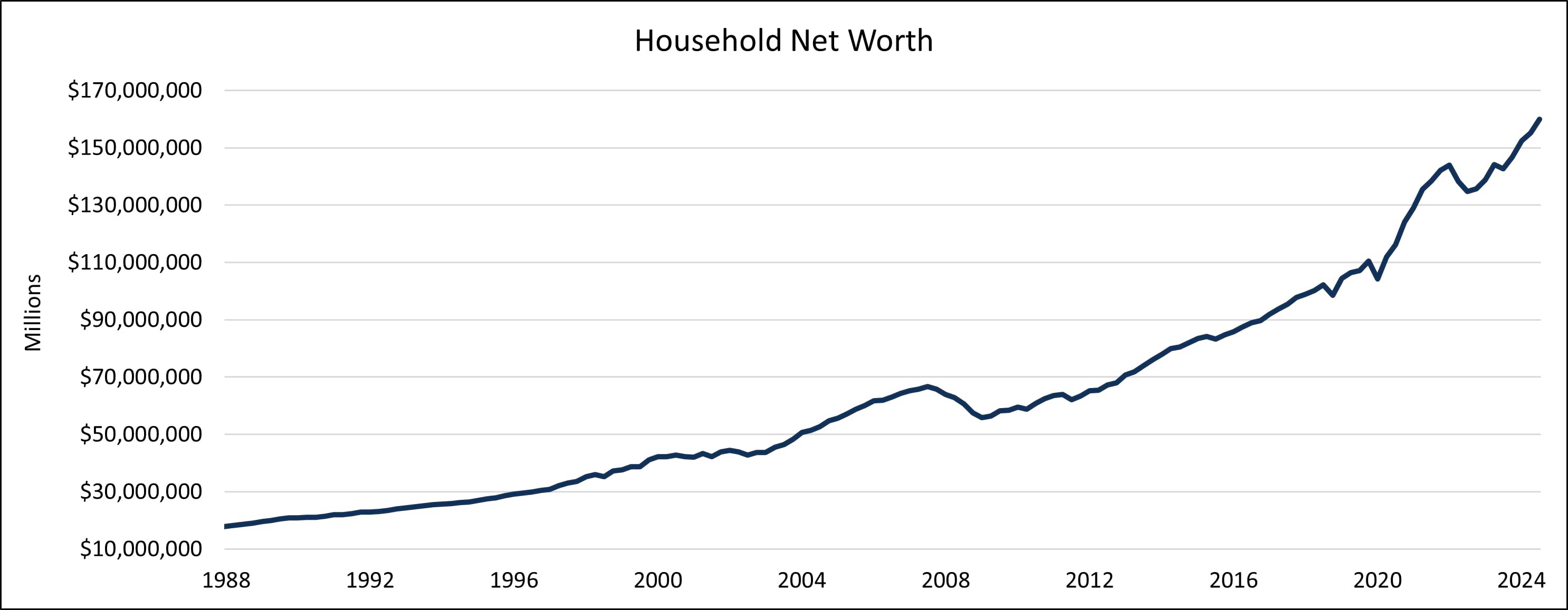

The U.S. economy is still healthy and the labor market, while a touch softer recently, is nowhere near weak enough to warrant recession fears. Inflation, while having ebbed from peak levels, remains stubbornly above the Fed’s Edenic 2% target. Consumer confidence signals euphoria, likely driven by robust equity markets, which in turn translate into consumer wealth, as illustrated in the three charts below:

Speculation is that some of this unbridled optimism may be due to political affiliation, but the longer-term charts seem to tell a more nuanced story. We have a still healthy economy combined with rising consumer wellbeing and record optimism about future stock returns. Heightened investor optimism is palpable, and if we have learned anything from our investing experience, at a minimum this should be taken as a flashing yellow light.

The Fed has continued to cut rates despite grumblings from the bond market that cuts were not yet needed. As evidence, we can see that except for the very short end of the yield curve, the reaction to Fed cuts has generally been negative. The yield on the 10-year Treasury since the Fed began easing on September 18th has risen from 3.70% to 4.57% on December 31st, almost 90 basis points, while the yield on the 2-year Treasury has risen from 3.62% to 4.24%, over 60 basis points. Clearly, the bond market is at odds with the Fed regarding the durability of future economic growth and inflation. But maybe the Fed is coming around. Following its December meeting, the Fed released predictions for interest rates, in the form of its famous, or should we say infamous, Dot Plots. What they show is that the Fed governors now predict a median terminal rate for year-end 2025 at 3.88% versus their prior estimate of 3.38%. This means that we will likely only have two cuts in the fed funds rate this year versus the four they were predicting previously. While we have shown in the past that these predictions are not very reliable, they do reflect a change in sentiment at the Fed and the markets have taken note. The steepening of the yield curve is finally happening. We believe that this is due to the realization that we will likely have a slower glide path for inflation to reach the Fed’s 2% target, combined with a still healthy economic backdrop.

In sum, the U.S. equity markets are at all-time highs, commensurate with richer valuations, in turn driving consumer confidence to record highs too. Additionally, interest rates beyond the one-year tenor continue to rise, while much of the developed world is in or near recession levels and cutting rates. There is much handwringing on trade and tariffs, which could cause inflation to stay elevated at a minimum and possibly rise at worst. We also point out that there is currently a historically high valuation differential between small and large cap equities, so if the economy begins to slow, finding stocks with true growth potential will be very desirable. Traditionally these have been found in newer, fast growing smaller companies. Given that the mega cap stocks, which have led the S&P 500 index, have fabulous businesses with almost insurmountable competitive advantages, we may not have a repeat of the post dot-com era bust, but as yields rise on long-term Treasuries the hurdle rate for returns versus a risk-free rate also rises. This may translate into tepid equity returns for a period of time. As we showed above, following the last peak in 2000, fixed income did considerably better than equities, and perhaps that should be considered when making portfolio allocations for long-term investments.

As many of you know, we continue to position defensively while not sacrificing much yield (or returns), given the inverted yield curve we enjoyed for most of 2024. In addition to favoring very near maturities during the inverted yield curve era, we have recently been gradually moving from cash-like instruments into slightly longer- but still shorter-term bonds, as yields continue to rise for tenors one year and out. We have also been finding short-dated convertible bonds in financially strong companies with very competitive yields. We are still waiting for a deeper correction before we materially increase our duration in order to lock in much higher yields than we are seeing today.

Thank you for your continued confidence in our management.

Carl Kaufman

Co-President, Co-Chief Executive Officer, Chief Investment Officer – Strategic Income & Managing Director – Fixed Income

Bradley Kane

Vice President & Portfolio Manager – Strategic Income

Craig Manchuck

Vice President & Portfolio Manager – Strategic Income

John Sheehan, CFA

Vice President & Portfolio Manager – Strategic Income

The Fund was rated 4 Stars against 586 funds Overall, 5 Stars against 586 funds over 3 Years, 4 Stars against 537 funds over 5 Years, 4 Stars against 423 funds over 10 Years in the High Yield Bond category based on risk-adjusted returns as of 3/31/25.

The Morningstar Rating™ for funds, or “star rating,” is calculated for mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period has the greatest impact because it is included in all three rating periods.

© 2025 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.The Osterweis Funds are available by prospectus only. The Funds’ investment objectives, risks, charges, and expenses must be considered carefully before investing. The summary and statutory prospectuses contain this and other important information about the Funds. You may obtain a summary or statutory prospectus by calling toll free at (866) 236-0050, or by visiting www.osterweis.com/statpro. Please read the prospectus carefully before investing to ensure the Fund is appropriate for your goals and risk tolerance.

Mutual fund investing involves risk. Principal loss is possible.

The Osterweis Strategic Income Fund may invest in debt securities that are un-rated or rated below investment grade. Lower-rated securities may present an increased possibility of default, price volatility or illiquidity compared to higher-rated securities. The Fund may invest in foreign and emerging market securities, which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks may increase for emerging markets. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Small- and mid-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Higher turnover rates may result in increased transaction costs, which could impact performance. From time to time, the Fund may have concentrated positions in one or more sectors subjecting the Fund to sector emphasis risk. The Fund may invest in municipal securities which are subject to the risk of default.

Past performance does not guarantee future results.

This commentary contains the current opinions of the authors as of the date above, which are subject to change at any time, are not guaranteed, and should not be considered investment advice. This commentary has been distributed for informational purposes only and is not a recommendation or offer of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

No part of this article may be reproduced in any form, or referred to in any other publication, without the express written permission of Osterweis Capital Management.

Current and future holdings are subject to risk.

As of 12/31/24 the Osterweis Strategic Income Fund did not hold a position in Cisco or Nvidia.

Investment grade/non-investment grade (high yield) categories and credit ratings breakdowns are based on ratings from Standard and Poor’s, which is a private independent rating service that assigns grades to bonds to represent their credit quality. The issues are evaluated based on such factors as the bond issuer’s financial strength and its ability to pay a bond’s principal and interest in a timely fashion. Standard and Poor’s ratings are expressed as letters ranging from ‘AAA’, which is the highest grade, to ‘D’, which is the lowest grade. A rating of BBB- or higher is considered investment grade and a rating below BBB- is considered non-investment grade. Other credit ratings agencies include Moody’s and Fitch, each of whom may have different ratings systems and methodologies.

Performance data quoted represent past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by calling shareholder services toll free at (866) 236-0050.

A basis point is a unit that is equal to 1/100th of 1%.

Treasuries are securities sold by the federal government to consumers and investors to fund its operations. They are all backed by “the full faith and credit of the United States government” and thus are considered free of default risk.

Yield is the income return on an investment, such as the interest or dividends received from holding a particular security. A yield curve is a graph that plots bond yields vs. maturities, at a set point in time, assuming the bonds have equal credit quality. In the U.S., the yield curve generally refers to that of Treasuries.

The fed funds rate is the rate at which depository institutions (banks) lend their reserve balances to other banks on an overnight basis.

The S&P 500 Index is widely regarded as the standard for measuring large cap U.S. stock market performance. The index does not incur expenses, is not available for investment, and includes the reinvestment of dividends.

ICE BofA U.S. High Yield Index tracks the performance of U.S. dollar denominated below-investment grade corporate debt publicly issued in the U.S. domestic market.

ICE BofA U.S. Treasury Index tracks the performance of U.S. dollar denominated sovereign debt publicly issued by the U.S. government in its domestic market. Issues must carry a term to maturity of at least one year, a fixed coupon schedule, and a minimum amount outstanding of $1 billion.

ICE BofA U.S. Corporate Index tracks the performance of U.S. dollar denominated investment grade corporate debt publicly issued in the U.S. domestic market.

Effective 6/30/22, the ICE indices reflect transactions costs. Any ICE index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its Third Party Suppliers and has been licensed for use by Osterweis Capital Management. ICE Data and its Third Party Suppliers accept no liability in connection with its use. See https://www.osterweis.com/glossary for a full copy of the Disclaimer.

These indices do not incur expenses and are not available for investment. The indices include reinvestment of dividends and/or interest.

Coupon is the interest rate paid by a bond. The coupon is typically paid semiannually.

Duration measures the sensitivity of a fixed income security’s price to changes in interest rates. Fixed income securities with longer durations generally have more volatile prices than those of comparable quality with shorter durations.

Osterweis Capital Management is the adviser to the Osterweis Funds, which are distributed by Quasar Distributors, LLC. [OCMI-663911-2025-01-08]