First Quarter Equity Outlook

Published on January 27, 2025

Equity markets are facing a variety of headwinds, but the economy remains strong, and we believe there will be ample opportunities to invest in attractively valued quality growth companies in 2025.

Climbing the Wall of Worry

The market is expensive and concentrated relative to history, and interest rates are now expected to remain elevated compared to recent expectations. This is a worrying set of facts that has caught our attention, leading us to question whether the equity market is due for a significant pullback.

The problem with trying to answer this question definitively is that reality is quite nuanced: Risks are somewhat elevated due to stickier inflation and high valuations, but the economy is overall in excellent shape, and the market concentration can be justified by the significantly better fundamentals of the Magnificent 7 compared to the rest of the market.

We have thus taken a barbell approach by raising our defensive exposure while continuing to own certain rapidly growing businesses, all underpinned by our quality growth approach, which we believe should protect portfolios while allowing for upside capture.

Market Valuation: A Closer Examination

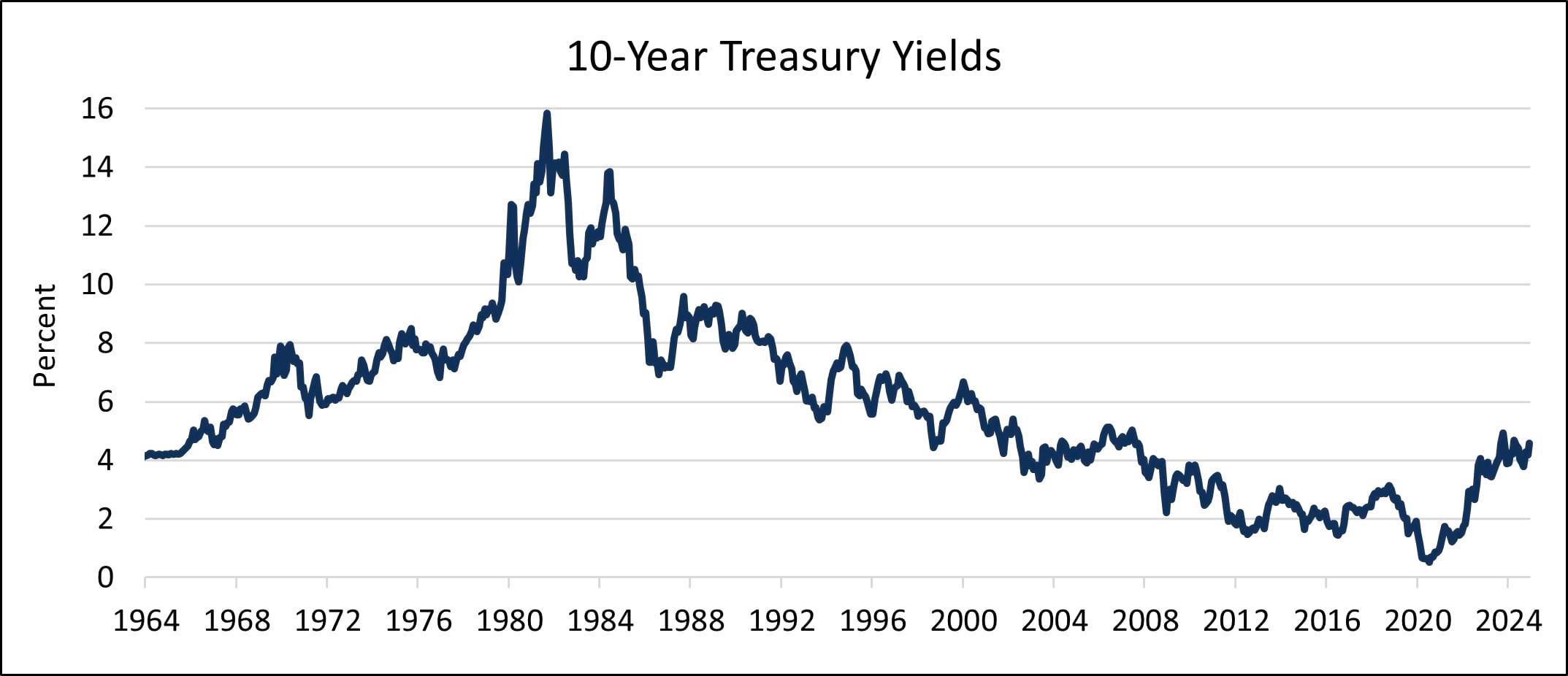

As of year-end 2024, the S&P 500 Index traded at 22x EPS estimates for 2025. Meanwhile, the Magnificent 7 compose roughly 35% of the overall S&P 500. Goldman Sachs reports that current levels of market concentration are unprecedented going back through decades of market history. The Federal Reserve also announced in mid-December 2024 that it expects to slow the pace of interest rate cuts going forward due to stickier inflation. As a result, the 10-year U.S. Treasury yields are now over 4.5% — back to levels last seen in the mid-2000s and now in line with the S&P 500 earnings yield of roughly 4.5%.

At first blush, the S&P 500 priced at 22x forward EPS looks downright expensive. Consider that the long-term forward multiple of the S&P 500 has been roughly 17x over the past 30 years. However, examining a P/E multiple in isolation can overlook some key facts worth exploring.

First of all, earnings for the overall S&P 500 grew at almost 10% year-over-year in 2024. Secondly, earnings growth in 2025 is expected to accelerate rapidly to 17% over the previous year for the overall index. Over the past ten years, the S&P 500 has experienced earnings growth on average of just 8%, meaning that 2024 earnings growth was about 25% faster than normal, and earnings in 2025 are expected to grow at double the historical pace. This higher earnings growth is a function of both higher-than-historical revenue growth and significantly higher-than-historical net profit margins.

Using a PEG approach — widely popularized by the legendary investor Peter Lynch, whereby the P/E ratio is divided by projected earnings growth — can provide important context for today’s equity market valuation. Simplistically, a lower PEG should be more attractive given that either the multiple is low and/or EPS growth expectations are high. Conversely, a higher PEG should raise red flags, as this would imply high valuation and/or low expected future EPS growth.

Per Bloomberg, EPS for the overall S&P 500 is expected to grow 17% in 2025 and 13% in 2026, implying an annualized growth rate of roughly 15% over the next two years. This would translate to a current market PEG of about 1.5x (that is the market P/E of 22x divided by the average EPS growth rate of 15%). Using the historical average S&P 500 multiple of 17x over the past 30 years cited above, and historical annual EPS growth of 7% over the same 30-year period, it would imply a long-term market PEG of 2.4x for the overall S&P 500. In other words, today’s market valuation looks cheap relative to earnings growth, as the elevated market multiple could simply reflect expectations of higher earnings growth — double the 30-year average EPS growth of the S&P 500 as mentioned.

An astute analyst would point out that returns on capital and the reinvestment of capital ultimately drive EPS growth. Using return on equity (ROE) as a simple proxy, market ROE is near an all-time high of about 20% versus a historical range of 10-15%. Consistent with near all-time high ROEs, net profit margins are also near all-time highs. Importantly, financial leverage, which can artificially elevate ROE and jeopardize future growth, is at historically low levels — a key consideration in the context of interest rates that are back to what we consider healthy and normal levels.

But What About Market Concentration?

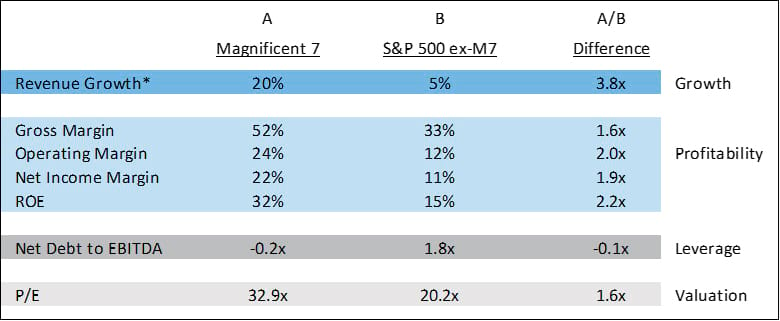

We have extensively discussed the current levels of market concentration. As noted above, the Magnificent 7 accounts for roughly 35% of the overall S&P 500, well above historical norms. This level of concentration worries us, but again context is critical.

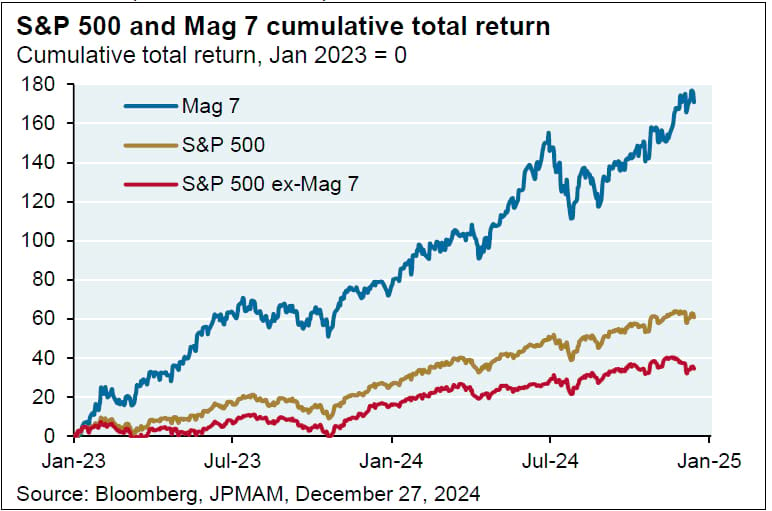

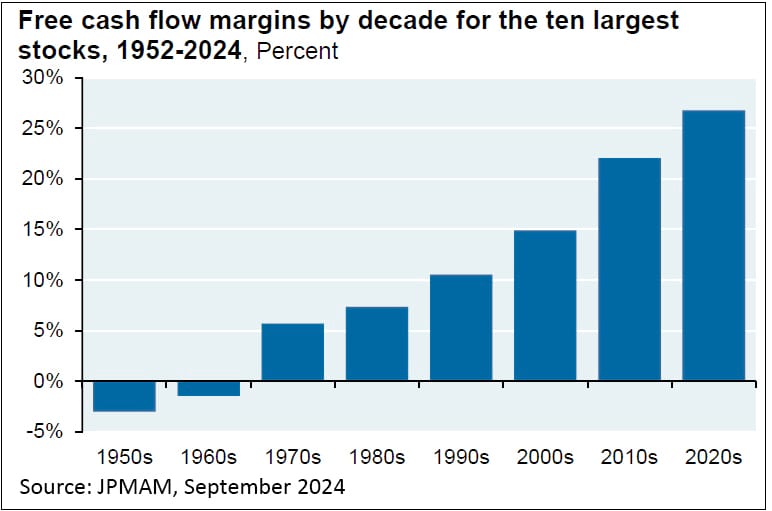

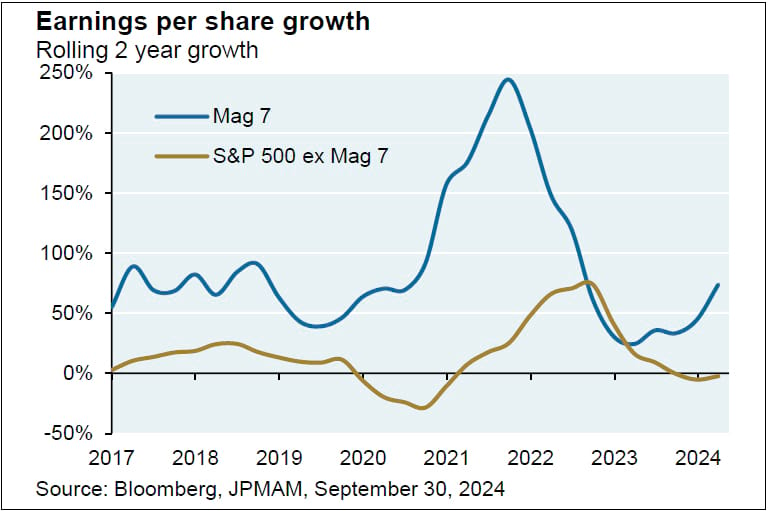

JP Morgan has assembled the data to show that the Magnificent 7 continue to drive returns, but arguably for good reason. The largest companies have structurally become much more profitable, enabling continual reinvestment, which in turn drives earnings growth well above that of the rest of the market.

And returning to and updating an analysis we laid out 12 months ago in our outlook, the Magnificent 7 boast fundamentals significantly better than the other 493 companies in the index: 4x the revenue growth, 2x the profit margin and ROE, and with more cash than debt on their balance sheets. Put simply, the Magnificent 7 exhibit extraordinary financial characteristics that justify a premium — the question is how much of a premium.

Interest Rates – Back to Normal

While the Fed’s commentary on December 18th sent the market into a tailspin, with equities selling off and yields across the Treasury curve moving higher, the news was not all bad. A key change that market participants focused on was the Fed’s anticipation of just two rate cuts in 2025 versus four cuts forecasted as of the prior meeting in September. A key risk raised by the Fed — one we have repeatedly flagged — is that actions by the incoming Trump administration may drive more persistent inflation going forward, compelling policymakers to keep rates more elevated to prevent a return of the highly elevated inflation witnessed in 2022-23.

Generally speaking, lower rates are preferable for economic growth, as low interest rates reduce borrowing costs for individuals and companies, enabling consumers to spend more on everything from cars to homes to clothes and companies to invest more for future growth. Lower rates also set the baseline level of valuations across the economy, with lower rates theoretically implying higher equity multiples, all else equal. However, the current rate environment is not particularly extraordinary relative to history. In fact, over the past roughly 65 years, today’s 10-year Treasury yield of 4.6% looks prosaic and in line with long-term trends, while the 15 years from 2007-23 that saw sub-4.0% 10-year yields look like an aberration and the mirror image of the hyperinflation-driven elevated rates of the early 1980s.

And given the strength of the overall economy — with real GDP growing at an annualized 3.1% rate, unemployment at 4.2%, and inflation at 2.7% — a 10-year yield of 4.6% seems eminently reasonable, especially in the context of potentially higher inflation from Trump’s threat to raise tariffs and severely limit immigration. Therefore, we are not overly concerned that current levels of interest rates will choke off economic growth.

But What About the Future?

Going forward we think market valuations will likely come down and the market will broaden while rates will remain elevated — so we are shaping client portfolios accordingly.

The current 22x P/E looks rich — even if ROEs and margins are structurally moving higher, resulting in higher EPS growth. We believe that the current market P/E multiple is likely positioned to fall below 20x. We would view this as a healthy outcome that could help to avoid a valuation bubble.

In terms of the Magnificent 7, we believe several of these companies are very well positioned going forward, and some are downright cheap relative to earnings and free cash flow. Therefore, owning at least several of these companies (as we do in client portfolios) is the right decision. However, we are highly confident that at least a couple will be dethroned in terms of competitive positioning, not to mention P/E is at an eye-popping 120x in one case – a valuation we cannot justify. Thus, we believe the market could broaden beyond the Magnificent 7.

Lastly, the incoming presidential administration is hard to predict. On the one hand, we expect less regulation, more favorable tax treatment, and more onshoring that should increase industrial activity. On the other hand, trade and immigration policy changes could raise the level of inflation going forward. This lack of clarity makes us nervous.

Portfolio Approach

We think the right strategy is to be both offensive and defensive, using a barbell approach. In the last 12 months, we have shifted our portfolios by trimming and exiting companies sporting higher valuations. We have also increased our defensive positioning through shifts towards Health Care, Consumer Staples, and Utilities. At the same time, we are maintaining high exposure to Technology and Industrials and have increased our Financials holdings. Despite the high valuations in certain segments of the market, we continue to find idiosyncratic opportunities that fit our long-term investing approach.

Underlying our portfolio construction is a consistent quality growth framework, whereby we invest in well-managed companies with significant and durable competitive advantages that can reinvest to drive future growth. We think that if we can be disciplined about valuation and stay focused on the long term, clients should be well rewarded by achieving attractive returns in up markets and being protected in down markets.

We would like to thank our clients for the trust you have placed in us and to wish all a healthy, happy, and prosperous new year.

John Osterweis

Founder, Chairman & Co-Chief Investment Officer – Core Equity

Gregory Hermanski

Co-Chief Investment Officer – Core Equity

Nael Fakhry

Co-Chief Investment Officer – Core Equity

The Osterweis Funds are available by prospectus only. The Funds’ investment objectives, risks, charges, and expenses must be considered carefully before investing. The summary and statutory prospectuses contain this and other important information about the Funds. You may obtain a summary or statutory prospectus by calling toll free at (866) 236-0050, or by visiting www.osterweis.com/statpro. Please read the prospectus carefully before investing to ensure the Fund is appropriate for your goals and risk tolerance.

Mutual fund investing involves risk. Principal loss is possible.

Past performance does not guarantee future results. Index performance is not indicative of fund performance. To obtain fund performance, visit https://www.osterweis.com/mutual_funds/osterweis/performance.

This commentary contains the current opinions of the authors as of the date above, which are subject to change at any time, are not guaranteed, and should not be considered investment advice. This commentary has been distributed for informational purposes only and is not a recommendation or offer of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

No part of this article may be reproduced in any form, or referred to in any other publication, without the express written permission of Osterweis Capital Management.

Current and future holdings are subject to risk.

Complete holdings of all Osterweis mutual funds (“Funds”) are generally available ten business days following quarter end. Holdings and sector allocations may change at any time due to ongoing portfolio management. Fund holdings as of the most recent quarter end are available here: Osterweis Fund

Earnings per share (EPS) is the company’s profit per outstanding share of common stock.

Earnings yield is the earnings per share for the most recent 12-month period divided by the current market price per share.

Price-to-Earnings (P/E) Ratio is the ratio of a company’s stock price to its 12 months’ earnings per share.

Earnings growth is the rate of growth of earnings. Earnings growth is not a measure of future performance.

PEG Ratio is the P/E ratio divided by annual earnings growth.

EBITDA is an acronym for Earnings Before Interest, Taxes, Depreciation, and Amortization.

Free cash flow represents the cash that a company is able to generate after laying out the money required to maintain and expand the company’s asset base. Free cash flow is important because it allows a company to pursue opportunities that enhance shareholder value.

Gross profit margin is revenue, less the cost of goods sold (COGS), divided by revenue.

Net profit margin is net income (after COGS, operating expenses, interest, taxes, and other non-operating costs), divided by revenue.

Operating profit margin is calculated by dividing a company’s net income (excluding interest, taxes, and other non-operating costs) by its net sales.

The Magnificent 7 stocks are Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla.

Return on invested capital (ROIC) is a calculation used to assess a company’s efficiency at allocating the capital under its control to profitable investments.

Return on equity (ROE) is the amount of net income as a percentage of shareholders’ equity.

Gross Domestic Product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period.

The S&P 500 Index is widely regarded as the standard for measuring large cap U.S. stock market performance. The index does not incur expenses, is not available for investment, and includes the reinvestment of dividends.

Osterweis Capital Management is the adviser to the Osterweis Funds, which are distributed by Quasar Distributors, LLC. [OCMI-669493-2025-01-15]