A Contrarian View: Now Is Still the Time to Invest in Growth

Published on April 15, 2019

In early November 2018 we published a blog post claiming that the time was right to invest in growth. In this piece, we revisit our analysis and draw the same conclusion.

Our original article was based on research from Cornerstone Macro, who released a report arguing that the early stage of a cooling economy is an excellent environment for growth stocks. It was a contrarian position, as the traditional response to an economic slowdown is to rotate out of growth stocks and into value-oriented companies. We summarized the argument this way:

A slowdown favors growth firms because it is a more challenging environment in which to operate, significantly reducing the number of companies that are able to deliver steadily increasing earnings.

It turned out that the emerging concerns about the economy in October rapidly escalated into fears of a full-blown recession in late November and December, triggering a fourth quarter selloff that left every major equity index negative for the year.

Those fears subsided in January, and the first quarter of 2019 has been a return to normalcy. Equity indices have mostly recovered and markets are back in equilibrium, so we felt it was a good time to revisit our previous analysis.

Our conclusion remains unchanged. Based on both recent macroeconomic data and market returns, we continue to feel that now is a good time to invest in growth stocks. More generally, we believe that secular growth trumps cyclical growth, particularly during a downturn.

Economic Indicators Point to Slowing Growth

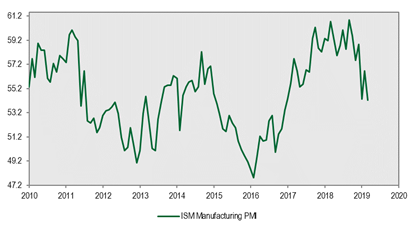

Cornerstone uses the Institute for Supply Chain Management’s Purchasing Manager’s Index (ISM PMI) as its leading indicator to measure economic activity. As the chart below shows, PMI has been falling steadily since peaking in late 2018.

Source: Cornerstone Research

More importantly, signs of a cooling economy prompted the Federal Reserve (the Fed) to pause its interest rate hiking program at its March meeting. Following the decision, the Fed released a statement saying “the growth of economic activity has slowed from its solid rate in the fourth quarter…. Recent indicators point to slower growth of household spending and business fixed investment in the first quarter.”

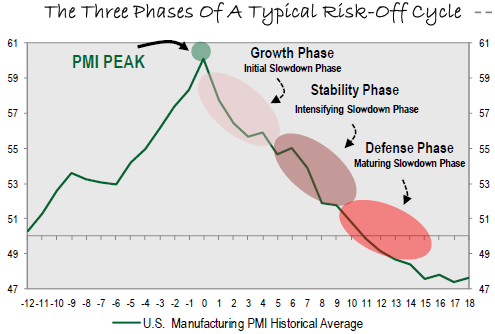

As we discussed in our last post, according to Cornerstone, “History shows that the sweet-spot for growth, cyclically speaking, is the period that follows a peak in economic prospects.” The chart below shows how they model the phases of a risk-off cycle. The x-axis indicates the number of months each phase is away from the peak (e.g., the initial slowdown starts directly after the peak and ends five months later).

Source: Cornerstone Research

While we fully agree with Cornerstone’s premise, we think the lifespan of the phases in their model may be too short given the current economic conditions. Evidence of a slowdown is mounting, but the deceleration appears to be measured. Assuming the current trajectory continues, we think the transition to the defensive phase could take materially longer than Cornerstone’s model suggests.

Growth Stocks Outperforming

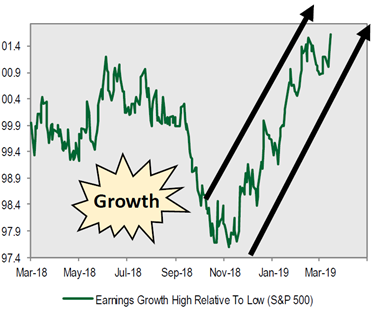

Cornerstone has assembled a series of single-variable analyses that track the returns for stocks in the S&P 500, and the growth-oriented companies have all been performing quite well. For example, in the chart below you can see that the firms in the S&P 500 with high earnings growth (i.e., the most basic definition of a growth stock) have steadily outperformed those with lower earnings growth since last November (which coincides with the peak in PMI).

Source: Cornerstone Research

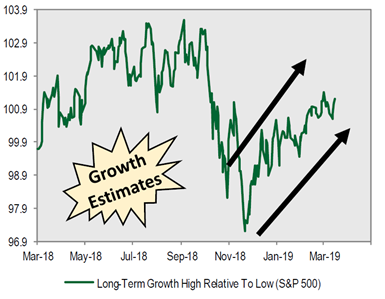

Likewise, stocks in the S&P 500 with higher growth estimates have also outperformed over that same period.

Source: Cornerstone Research

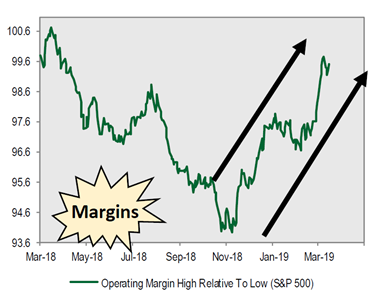

As have firms with higher operating margins.

Source: Cornerstone Research

In each case, the pattern supports the argument that growth stocks do well in the early stages of a slowdown, which is historically when secular growth has outperformed cyclical growth.

We will monitor these trends to see how they evolve, but for the time being we continue to believe that the near-to-medium term should be a good time to buy growth stocks.

James Callinan, CFA

Chief Investment Officer – Emerging Growth

Opinions expressed are those of the author, are subject to change at any time, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. The Osterweis Emerging Opportunity Fund may invest in unseasoned companies, which involve additional risks such as abrupt or erratic price movements. The Fund may invest in small and mid-sized companies, which may involve greater volatility than large-sized companies. The Fund may invest in IPOs and unseasoned companies that are in the early stages of their development and may pose more risk compared to more established companies. The Fund may invest in ETFs, which involve risks that do not apply to conventional funds. Higher turnover rates may result in increased transaction costs, which could impact performance. From time to time, the Fund may have concentrated positions in one or more sectors subjecting the Fund to sector emphasis risk. The Fund may invest in foreign and emerging market securities, which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks may increase for emerging markets.

Holdings and allocations may change at any time due to ongoing portfolio management. References to specific investments should not be construed as a recommendation to buy or sell the securities. Current and future holdings are subject to risk.

The ISM Manufacturing Index monitors employment, production, inventories, new orders and supplier deliveries. The Index is based on surveys of more than 300 manufacturing firms by the Institute for Supply Management (ISM).

The S&P 500 Index is an unmanaged index that is widely regarded as the standard for measuring large cap U.S. stock market performance. The index does not incur expenses, is not available for investment, and includes the reinvestment of dividends.

Earnings growth is the annual rate of growth of earnings from investments.

The Osterweis Funds are available by prospectus only. The Funds’ investment objectives, risks, charges and expenses must be considered carefully before investing. The summary and statutory prospectuses contain this and other important information about the Funds. You may obtain a summary or statutory prospectus by calling toll free at (866) 236-0050, or by visiting www.osterweis.com/statpro. Please read the prospectus carefully before investing to ensure the Fund is appropriate for your goals and risk tolerance.

Osterweis Capital Management is the adviser to the Osterweis Funds, which are distributed by Quasar Distributors, LLC. [38776]