Money Life with Chuck Jaffe: Interview with Nael Fakhry

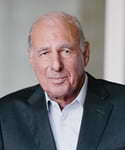

Portfolio Manager Nael Fakhry makes his debut on “Market Call,” a segment of the Money Life podcast, where he discusses the team’s methodology behind the Growth & Income Fund and examples of what they consider quality growth stocks.